Business Brokerage & Advisory

OVERVIEW

Business brokers assist buyers and sellers of privately held businesses in the buying and selling process. They typically estimate the value of the business; advertise it for sale with or without disclosing its identity; handle the initial potential buyer interviews, discussions, and negotiations with prospective buyers; facilitate the progress of the due diligence investigation and generally assist with the business sale.

Brokers can play a very valuable role in the process as they provide guidance, advice, and other resources that a client may need to make the transaction happen. Amro Brokers have years of training and experience in buying and selling small to medium sized businesses and therefore can provide you the expert guidance that can save you precious time and money. Amro Brokers are well connected with finance professionals, accountants, attorneys, and other professionals who may be needed to facilitate the sale. For sellers, Amro brokers can put together the marketing package, help determine the appropriate price for the business, and do all the leg work necessary to market the business for sale.

Business Advisory & Consultancy

Advisory and Consultancy services for Merger & Acquisitions or disposition of businesses or other assets for Small to Mid-Market firms.

Amro experienced business brokers will provide a realistic opinion of value pre-sale with the understanding that the ideal buyer may pay a higher price. Our goal is the find the right buyer who, for strategic reasons, can pay an above market price.

The advantage to an owner working with an experienced Business Broker is that it allows the owner to concentrate on running the business, while maintaining a confidential process, with the Broker providing a sense of urgency between multiple purchasing groups.

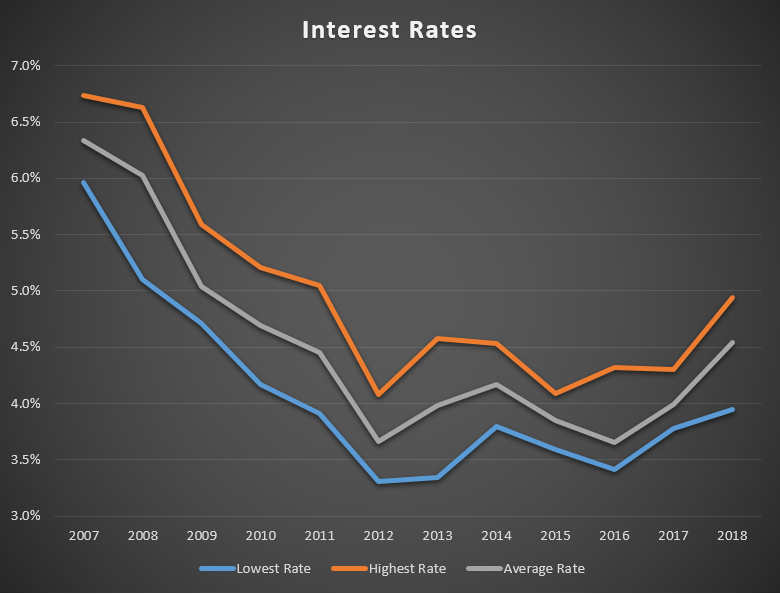

Over the past 48 years, interest rates on the 30-year fixed-rate mortgage have ranged from as high as 18.63% in 1981 to as low as 3.31% in 2012. Mortgage rates today remain at historical lows, with over 60% of mortgage holders paying rates between 3.00% and 4.90% as of 2015. The interest rate data was acquired from Freddie Mac's Primary Mortgage Market Survey (PMMS) to examine historical mortgage rates and the factors that have impacted their downward trend.

BUSINESS PLANNING & STRATEGY

Guide to Structuring Your Company | |

Structure | Key Elements |

| Sole Proprietorship An individual or married couple. | • Set-up costs are minimal; there’s no complex documentation to go through and no state fees. • Business income is taxed as personal income and is subject to self-employment tax. • Insurance can mitigate the liability to some extent. |

| General Partnership Has two or more owners (who aren’t a married couple). | • Set-up costs are minimal with no state fees or documentation. • Experts recommend a written agreement spelling out the partners’ responsibilities, how decisions will be made, how money will be spent, how profits will be split and how these terms will be adjusted if one partner is unable to meet his or her responsibilities; how new partners will be added; and how the partnership will end. • Business proceeds are taxed as the partners’ personal income. |

| Limited Partnership Similar to a general partnership, but has two classes of partner: limited and general. | • The general partner(s) bears the remainder of the liability and is responsible for day-to-day operations. • The limited partners’ liability is based on the percentage of their investment. • Besides the partnership agreement, many states require the partners to file a Certificate of Limited Partnership, as well. |

| Corporation A corporation is a legal entity, with a charter granted by the state in which it is headquartered. It can sell shares of stock to raise money; shareholders become part-owners based on the size of their investments. S Corporation is intended for businesses that don’t call for massive amounts of capital; they are legally allowed to have up to 100 shareholders (up from 75 beginning with the tax year 2004) and to issue just one class of stock. Income earned by the corporation is taxed as shareholders’ personal income. C Corporation status allows for an unlimited pool of shareholders. Stock can be issued in different classes, with different rights for shareholders. The corporation itself must pay taxes; business proceeds are taxed again when paid to shareholders as dividends. | • The corporation, not shareholders, is liable for its obligations. • Incorporation requires start-up fees and complex documentation. • Corporate entities are monitored by various governmental agencies and must comply with a variety of rules. |

| Limited Liability Company A hybrid entity that shields owners’ personal assets from business liability, but allows the returns they earn to be taxed once, as personal income. | • The law allows for an unlimited number of owners, called members, to invest in an LLC. • The relationships between an LLC’s members are documented in its Operating Agreement. |